Trusted Tax & Compliance Experts

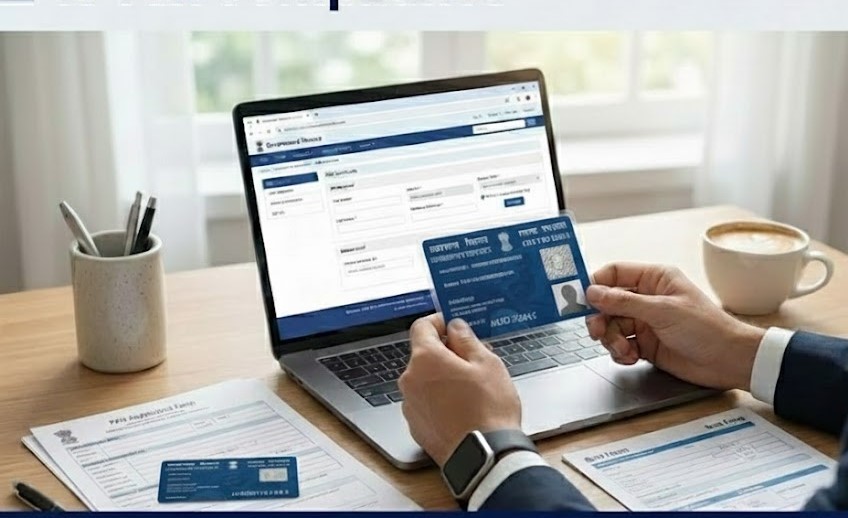

Simplifying Tax, GST & Business Registration for a Stress-Free Future

Welcome to Accure Tax Consultant, your one-stop destination for expert tax filing, GST services, company incorporation, and business compliance across India. With 10 + years of experience and 10,000 + satisfied clients, our qualified professionals deliver accurate, transparent, and on-time solutions for individuals, startups, and enterprises.